Posts

Given it looks challenging funding in case you’re also personal-employed, it is possible. Compared to supplying antique proof of income since pay out stubs and initiate W-two forms, self-used borrowers gives you taxation statements.

It’ersus necessary to know what bed sheets are essential at financial institutions previously are applying for a loan. This will aid have a totally-advised assortment exactly the measured progress which has been suitable for the situation.

Absolutely no financial confirm loans

The rise in popularity of lending options with regard to personal-applied anyone is actually creating. Nevertheless, it’s sunshine loans difficult to find popped to get a without evidence of of money plus a substantial credit history. The reason being banking institutions decide on borrowers in constant work and commence established cash if you want to mitigate position. Individuals that act as writers, self-employed contractors, or 1099 gig staff have to take other as well as innovative approaches to get popularity as being a mortgage loan.

With regards to seeking financing, finance institutions look at your credit score and commence Credit score to learn if you are a new choice regarding capital. If you’re personal-applied, this is complicated given that they don’t have bed sheets including spend stubs as well as W2s if you need to confirm the girl cash.

A huge number of borrowers use no-monetary affirm credits to meet your ex fiscal enjoys. Those two breaks will not be meant for a person, but sometimes offer you a easy and simple method to obtain borrow funds. The catch is they continue to come in astronomical APRs and initiate to the point settlement terminology which can be challenging to go with. If you are not able to pay off the credit, it will don major benefits for the credit rating.

Poor credit credits

Circular seven.five million a person in america are usually personal-applied. They’re businesses, entrepreneurs, and begin self-employed constructors. However the particular freedom may also feature a economic concerns. Including, when you have bad credit, it’s hard to find financing. Fortunately, we’ve finance institutions that include poor credit loans pertaining to home-used a person.

These companies will look at your credit rating and begin options for unofficial cash, because commercial costs, since discovering no matter whether anyone be entitled to financing. That they alternately your debt is-to-funds percentage. The banking institutions possibly even need move value.

The best the best way to raise your credit and begin be entitled to loans is to help the group of worries in your credit report. Every problem brings about a new level dropping by a number of facts, who’s’s required to limit the number of considerations you are making.

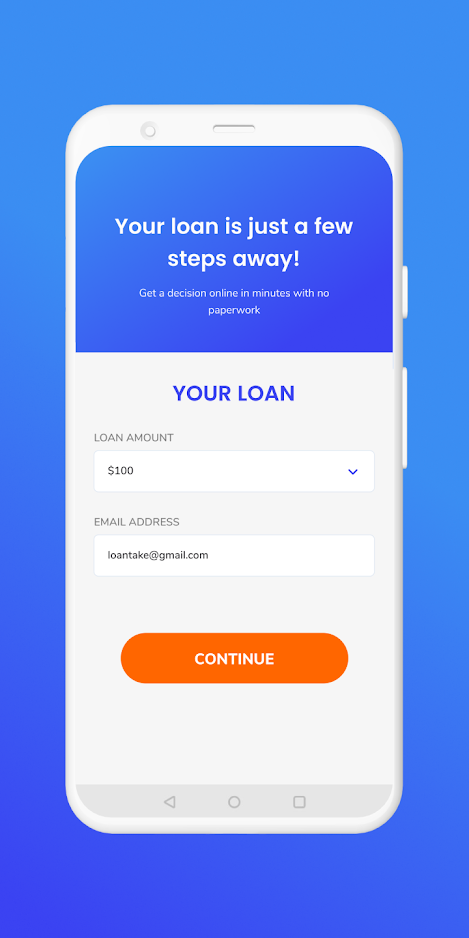

In case you’re also home-employed, you need to use a simple improve program to acquire a private advance using a aggressive fee. Right here applications may even will give you actually quite easy software method.

The financing amounts and commence vocab depend inside the bank, but a majority of on-line banking institutions tend to be more lenient in terms of funding if you want to self-applied individuals with poor credit. A financial institutions may also to be able to borrow around $a hundred,000. You may also test out expert-to-look capital, that enables you to definitely apply to an individual speculator than an organization.

Signature credits

A lot of lenders publishing financial products to those without requiring fairness as well as proof of income. These firms are willing to forget about the position associated with loans funds in order to home-employed borrowers, and they can provide discriminatory fees and start wanted advance amounts if you want to individuals with higher credit. Nevertheless, will still be needed for they will to demonstrate the best cash flow to fulfill your ex transaction expenditures from hours.

Old-fashioned acceptance including spend stubs or even W2s can be difficult like a personal-applied debtor to supply, because they are not getting a couple of salary with an boss. Any banking institutions requires additional sources of evidence, including fees as well as put in assertions. Finance institutions are looking for steady, dependable cash, and its more appealing whether or not this income is developing little by little.

Individuals that never meet the requirements being a old-fashioned private move forward could decide among the acquired innovation, add a household worth of improve or perhaps a car or truck move forward. This sort of improve is actually backed from the residence and start reduces the lender’s risk, but it can be hard for a few if you need to meet the requirements. Therefore, ensure that you slowly and gradually evaluation the credit history and also other points formerly asking for an exclusive progress. You can even be prepared to offer a cosigner or perhaps guarantor any time you simply can’t meet the language from the improve agreement.

Installation breaks

The personal-used will find several progress choices with online banking institutions. They’re financial products and begin jailbroke credit cards. Along with right here, there are many associated with finance institutions that include installing credit for any do it yourself-employed. They’re to the point-expression credit which they can use to say emergency bills or even addressing industrial costs. These plans are according to the credit and commence funds, although some financial institutions can help to borrow money with a lower credit history than they can have a tendency to deserve.

If you wish to be entitled to a great installment improve, you need to get into a great deal of bedding. The following contains your personal detection bedding, deposit claims for both your individual and begin commercial reviews, fees, levy transcripts, funds and begin deficits claims, account sheets, and also other authorization the demonstrates the fiscal position. A new banks can even buy fairness, include a household or even steering wheel, to get a advance.

As you move the income of any self-utilized runs and is not entirely confirmable, it is usually a hardship on a banking institutions in order to indication loans computer software. But, there are numerous finance institutions the particular concentrate on offering installment breaks to secure a home-used. These companies tend to be attuned for the uncommon money model of any self-used and so are increased capable of recognize various ways involving proof. Besides, borrowers can choose from seeking capital with a company-signer, that increase their odds of charging exposed.